December 20th, 2018

By Matt Miner

Dear Clients and Friends,

At PLC Wealth we enjoy a good New Years party as much as anybody. But we also know that the end of the year can be a chance to pause and reflect on how 2018 went, and what we aim to change in 2019.

We think it’s terrific to take some time to move from undefined “hope” to vision, and from vision to goals, and from goals to specific plans to make things happen in your life and your family. As our friend Dave Ramsey says, “Goals are visions and dreams with work clothes on.”

If you’re ready to get a jump on 2019, here are a few financial best practices for the year ahead. Pick one or two of them to tackle. Give us a call if you’d like to work together to translate these goals into specific plans you can achieve or begin to achieve in the coming year.

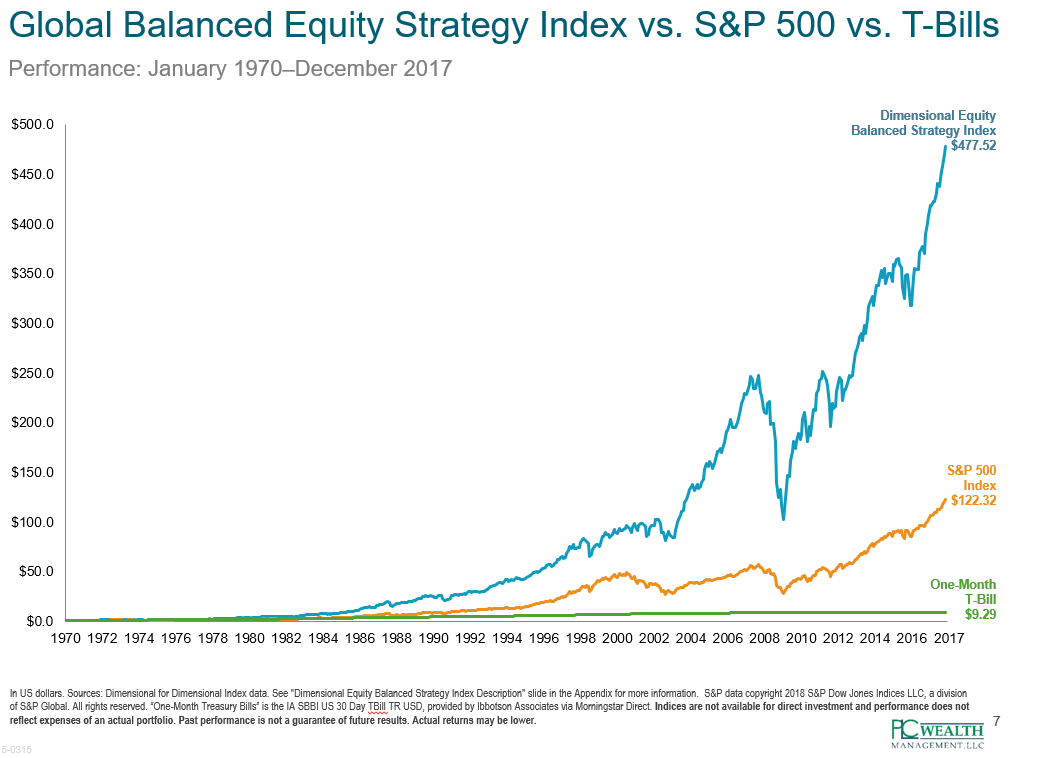

1. Do nothing

Seriously. If you have a well-built investment portfolio in place, guided by a relevant investment plan, your best move in hyperactive markets is to let that plan be your guide. That often means doing nothing new with your holdings except your planned, periodic rebalancing. We list investment inaction as a top priority, because “nothing” can be one of the hardest things to (not) do when the rest of the market is in perpetual motion!

2. Double down on your planning

In order to advance your SANF (“Sleep at Night Factor”) in volatile markets, you must have a relevant plan in place that you understand. That plan guides your portfolio and your new investments. A fresh new year can be a great time to tend to your investment plan – or create one, if you’ve not yet done so. Have any of your personal goals changed, or will they soon? How might this impact your investment mix? Have market conditions put your portfolio ahead or behind schedule? Are you unsure where you stand to begin with? It’s time well-spent to periodically ensure your plan remains relevant to you and your personal circumstances.

3. Prepare for the unknown with a rainy-day fund

Time will tell whether 2019 markets are friendly, foul, or (if it’s a typical year) an unsettling mix of both. Having enough liquid, rainy-day reserves to tide you through any rough patches is a best practice no matter what lies ahead. Knowing your near-term spending needs are covered should help with both the practical and emotional challenges involved in leaving the rest of your portfolio fully invested as planned, even if the markets take a turn for the worse.

4. Redirect your energy to contributing financial factors

While you’re busy staying the course with your investments, you can redirect your attention to any number of related financial and advanced planning activities. While you don’t necessarily need to act on everything at once, it’s worth reviewing your financial landscape approximately annually, and identifying areas in need of attention. Maybe you’ve got a debt load you’d like to reduce, or an estate plan that’s no longer relevant. Perhaps it’s been too long since you’ve reviewed your insurance line-up, or you’d like to revisit your philanthropic goals in the context of the latest tax laws. Refreshing any or all of these items is likely to contribute more to your financial success than will fussing over the stock market’s daily gyrations.

5. Perform a cybersecurity audit

Protecting yourself against cybercriminals is another excellent use of your time. With the new year, revisit a a few basic, protective steps:

Enable two-factor authentication on important accounts

Change key passwords on your most sensitive login accounts

Review your credit reports (using AnnualCreditReport.com)

Place a freeze on your credit file, to block unauthorized access (now free, based on recently enacted federal law)

Especially with child identity theft on the rise, these actions apply to your entire household. Unfortunately, even minor children are now at heightened risk.

6. Have “that money talk” with your kids, your parents, or both

When is the last time you’ve held any conversations about your family wealth? It’s never too soon to begin preparing your minor children for a financially literate adulthood. As they mature, their financial independence rarely happens by accident, with additional in-depth conversations in order. Then, as you and your parents age, you and your kids must prepare to step in and assist if dementia, disability or death take their tolls. There also can be ongoing conversations related to any legacy you’d like to leave as a family. For all these considerations and more, an annual “money talk” can be critical to successful outcomes. If you’d like help completing this task, PLC Wealth is ready to work with you to get it done.

7. Make 2019 a year you absolutely crush it in your work, business, or volunteer efforts

All of us are engaged in some kind of productive activity that puts us into contact with other people. This may be our career, our own business, a non-profit organization we serve, or simply running our family’s household.

We all have things we’d like to be different in our daily situation. As you conclude 2018, think back on items you would like to change in 2019. Focus on what you can change or influence, not what you can’t, concentrating your efforts your “locus of control.” For example, if you have a difficult boss or co-workers but you don’t want to change your actual employment, change how you respond emotionally to a difficult situation. Use tactics like focusing on what you are grateful for in this context, getting more exercise, or having that difficult conversation with someone about why a situation has become problematic for you.

Many of us have room to be more organized and focused on the vital few that really matter. Make a plan for how to tune out the noise and get the right things done.

Two great resources here are Stephen Covey’s Seven Habits of Highly Effective People, and David Allen’s Getting Things Done. If you don’t love reading, try an Audible audio book while you exercise or commute.

So, there you have it: seven creative ways to bolster your financial well-being while the stock market does whatever it will in the year ahead. While this list is by no means exhaustive, we hope you’ll find it an approachable number to take on … with two critical caveats.

First, we’ve got a bonus “financial best practice” to add to the list:

Above all else, remember what your money is for. Money is meant to fund your moments of meaning. At PLC Wealth, we want our clients to live rich, not die rich.

Second, we recognize that each of these “easy” best practices aren’t always so easy to implement. We could readily write pages and pages on how to tackle each one.

But instead of writing about them, we’d love to help you take action on these steps. At PLC Wealth, we work with families every day and over the years to convert their dreams into plans, and their plans into achievements. We work in the context of single-issue planning engagements, comprehensive financial planning, and investment management. We hope you’ll be in touch in the new year, so we can partner with you.

Merry Christmas & Happy New Year to you and your family from the team at PLC Wealth – Josh, Mike, Sandra, & Matt