December 19, 2019

By Matt Miner

Sometimes the past knocks on your door and reminds you to plan for your future.

The first story

Ben, our third child, was born during my second year of MBA studies at Duke University’s Fuqua School of Business. Ben first showed his face at the end of fall break. I returned to Fuqua on a Thursday, four days into the new Fall 2 term.

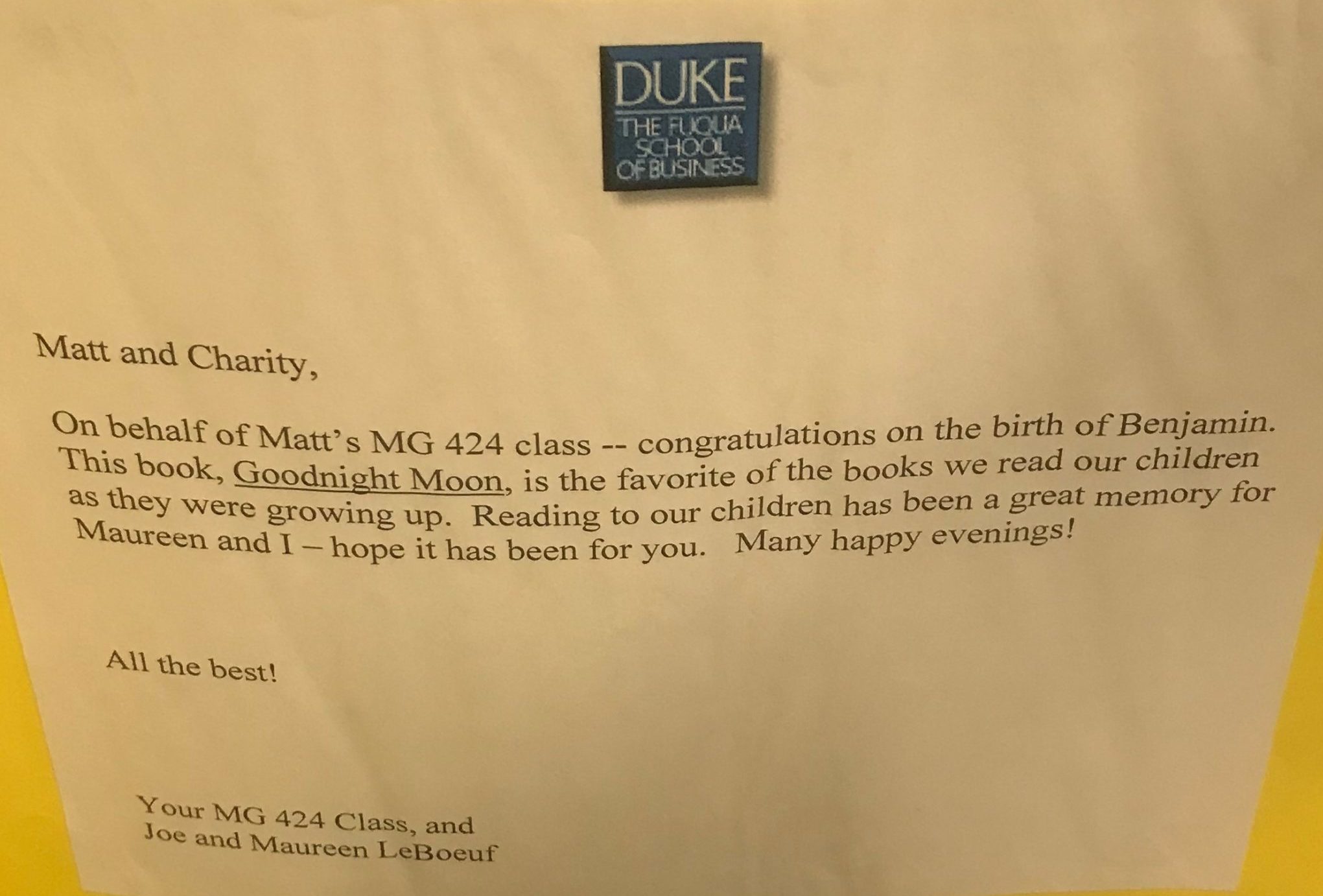

My leadership and management instructor, Joe LeBoeuf kicked off the class and then asked Team Fuqua to give me a round of applause as a new dad. He invited me to come up front. Joe presented me with an inscribed copy of Goodnight, Moon, congratulated me on the arrival of our third child, and encouraged me to read aloud to our children (which I still do, though they’re now 14, 12, and 11).

I could piece together the rest of my schedule that term from emails, or review my transcript. But I can’t name from memory any of my other instructors that fall; I can tell you about Joe LeBoeuf.

The second story

Lacey Langford is a Triad-based podcaster I know. She creates a weekly show called The Military Money Expert and has some terrific guests – I particularly recommend the interviews with Robert Frick and JD Roth.

As I scrolled through Lacey’s podcast feed, I got excited when I saw the interview with retired Brigadier General Maureen LeBoeuf. I knew Maureen was Joe LeBoeuf’s wife. I tuned in to the episode.

Maureen shares a bit of her story, but the most compelling part of the interview is when Lacey urges Maureen to talk about her leadership philosophy. This discussion held my attention because I am updating a family document (first crafted in 2015 and last updated in 2017) called the “Miner Family Vision, Values, and Goals.” It’s our family philosophy. Maureen tells Lacey:

[Your leadership philosophy] helps the people you are going to lead understand your point of view as a leader…it’s what they can expect from you. And it’s also an opportunity to let those you lead know what you’re going to expect of them.

The first thing is to think about your values…then you take those values and define them…People think, ‘I’ve got values.’ But they never sit down and do the deep dive into, ‘What are my values?’ and then the next step, ‘How do I define those values.’ And then when you share them…you need to live them, because people are going to see if you walk the talk.”

Maureen would not have achieved the same level of leadership and career success without carefully considering and then writing down her leadership philosophy. And while Maureen’s remarks are focused on leadership, the same thought process applies to your life and money.

What is real financial planning?

You need a point of view on your life – this is derived from your values. Then your values guide what you’re doing with the time, energy, talents, and money you have. If what you’re actually doing with your life differs from what you say you value, this is an opportunity to reflect whether your values are real values, or whether you should bring your efforts into greater alignment with what’s most important to you.

Ask yourself what you’d like your life to look and feel like in 1, 3, 5 or 10 years. That’s your vision.

Ask yourself what’s most important to you. These are your values. They shape how you use your time and money – and your use of time and money signal what you value.

Ask yourself what you need to have or do. These are your goals. Then, for each of your goals you create action steps that move you in the direction of the goal.

Ask yourself what you already have that you’re thankful for. This gets you in the right headspace to tackle a project like this.

And do it now. Completing this task before your new year begins is potent. You can always improve your document later. For any commitment of time or money you can ask whether it supports your vision of your life, whether it’s in harmony with your values, and whether it moves you closer or farther away from hitting your goals.

If this sounds overwhelming, it doesn’t have to be. Just a few sentences on each of these questions can be helpful in setting a course.

And this is the task we help clients accomplish, all day, every day.

The benefit of this exercise is in thinking it through and writing it down – not in accomplishing all your plans exactly as you imagined. That won’t happen. General Eisenhower said, “Plans are useless, but planning is indispensable.”

In Maureen’s context, her Army bosses provided powerful encouragement by requiring that she write down her leadership philosophy, share it with others, and hold herself accountable as part of her job.

In your context, working with an advisor, mentor, or coach can be a great way to write things down and build the momentum you need to hit the ground running and make real progress on your goals in 2020.

Additional Resources

Links to a three-part series on goal setting from my friend Joshua Sheats of Radical Personal Finance.