July 2025

The days are already getting shorter – barely noticeable, but real. And while many of us in the South still have some scorcher days ahead, the halfway point of the year is a good time to pause and reflect.

Market and Economic Overview

Feeling some whiplash from the markets lately? You’re not alone. It’s been a wild ride, and once again, it reminds us why we’re such big fans of staying in your seat. Global tensions have kept uncertainty front and center, which usually means more market volatility. In plain terms, the roller coaster gets steeper—both on the way down and the way back up.

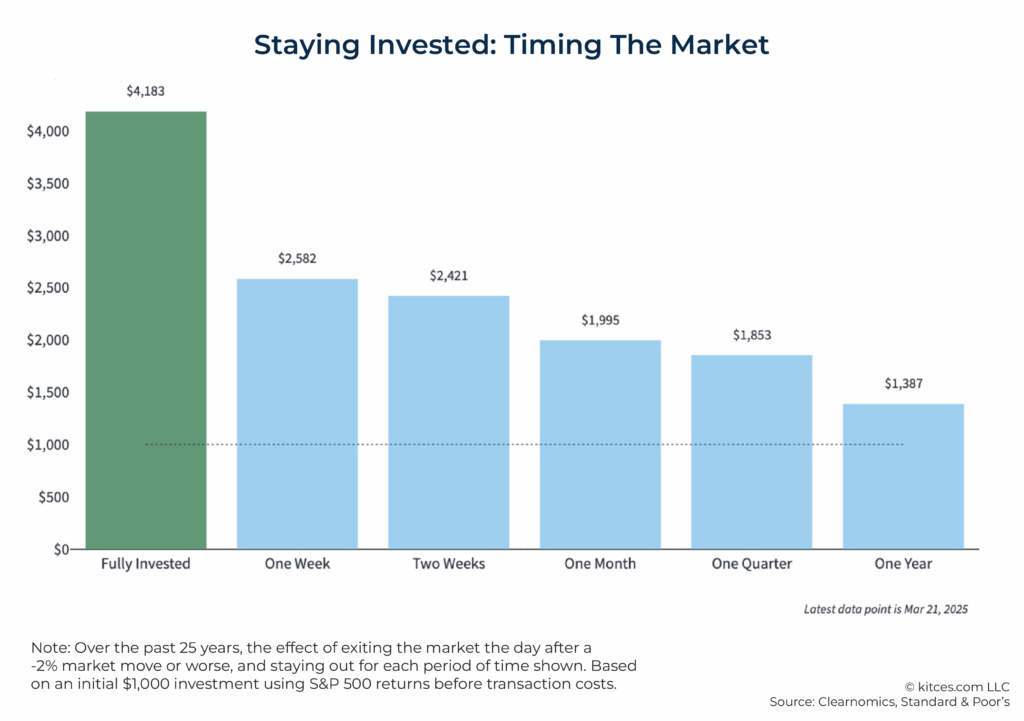

History has shown that some of the biggest market gains come right after sharp declines. The problem is, we never know exactly when that rebound will happen. Guessing wrong can be costly – and in some cases, set a portfolio back for decades (see the chart below).

In moments like the February 19th to April 8th drawdown this year – when the S&P 500 fell nearly 19% in just a few weeks – the temptation to jump off the ride can be strong. It will take your breath away. But staying disciplined and committed to your plan is what makes the difference. It’s time in the market, not timing the market, that leads to long-term success.

One note of caution: it’s important that money needed for near-term living expenses isn’t exposed to these kinds of market swings. Lately, we’ve become strong advocates of a liability-driven investment approach – matching your investments to specific future spending needs – rather than just thinking in terms of general asset allocation. If that’s unfamiliar, we’d love to talk more at your next meeting.

Money in Service of Values

When markets get noisy, perspective matters. Money is at its best when it serves what you truly value. That’s a theme I’ve heard repeatedly from recent guests on my On Adventure podcast—entrepreneurs, musicians, conservationists. The thread that runs through all their stories? Wealth isn’t the end goal. It’s a tool to create freedom, meaning, and impact.

What’s the point of building bigger buckets if the money never gets used to shape a better life—for yourself or someone else? When aligned with purpose, money becomes transformative. It allows us to live with integrity, build what matters, and contribute beyond ourselves. And yes, to seek out a few great adventures along the way. In that light, money becomes more than just currency. It becomes agency.

Thank you for your continued trust. Please feel free to reach out anytime.