A significant tax and spending package – nicknamed the One Big Beautiful Bill (OBBBA) – recently passed the U.S. House and is now being debated in the Senate. This isn’t just Capitol Hill chatter – it has direct implications for your financial plans, and I want to make sure you’re informed without getting bogged down by technical jargon.

Here are five key areas currently up for discussion:

SALT Deduction Cap: House Wants $40K, Senate Uncertain

The House-approved bill proposes raising the State and Local Tax (SALT) deduction cap significantly—from $10,000 up to $40,000 (joint filers), permanently. This is a notable change for anyone living in high-tax states or dealing with substantial property taxes.

The Senate, however, hasn’t fully embraced this increase yet. They’re leaning toward maintaining the current $10,000 cap, sparking intense negotiations.

What it means for you:

If you typically itemize and live in a higher-tax region, your deductions – and thus your tax bill – could swing substantially depending on the final agreement.

Child Tax Credit and Family Incentives

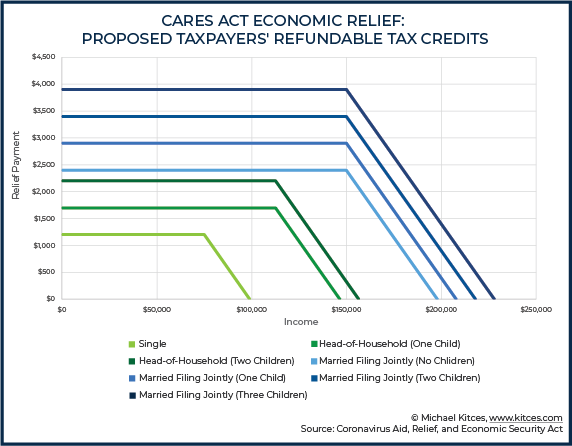

Both chambers agree broadly on enhancing the Child Tax Credit. The proposal currently extends the credit at $2,000 per child permanently, with a temporary increase to $2,500 per child until 2028.

The House version also includes a novel initiative: $1,000 “baby bonus” accounts for newborns through 2029. The Senate is debating this component, but no firm commitments yet.

What it means for you:

Enhanced child credits or potential baby savings accounts might mean extra breathing room in your budget or additional savings opportunities.

No Taxes on Tips and Overtime?

The bill includes bipartisan provisions to exempt certain tip income and overtime earnings from federal income tax, at least up to certain thresholds. This initiative targets workers in the hospitality industry, gig economy, and service sectors.

Both the House and Senate versions reflect strong support for making tips and overtime pay partially tax-exempt, potentially putting more money directly into workers’ pockets.

What it means for you:

If your income includes tips or overtime, your net earnings could rise, meaning immediate cash-flow improvements.

Green Energy Credits Could Change Drastically

The House version plans significant rollbacks of existing clean-energy incentives introduced previously under the Inflation Reduction Act. The Senate prefers a more moderate path—keeping credits for geothermal, hydropower, and nuclear energy intact longer, but phasing out solar and wind incentives sooner.

What it means for you:

If you’ve planned home efficiency upgrades or renewable-energy installations, these changes might affect your timing or feasibility, depending on what incentives remain.

Taxes on Social Security Income May Shift

An additional change currently debated is how Social Security income is taxed. The House bill includes proposals to raise the income thresholds at which Social Security benefits become taxable, meaning potentially fewer recipients would owe taxes on these benefits.

The Senate’s stance isn’t finalized yet, but similar adjustments are being seriously considered.

What it means for you:

Retirees—or soon-to-be retirees—might see significant shifts in their taxable income, impacting cash flow, retirement planning strategies, and possibly allowing greater flexibility in your spending plans.

Broader Implications and Timing

Deficit Impact:

The Congressional Budget Office (CBO) estimates the bill could increase the federal deficit by $2.8–$3.8 trillion over the next decade. The tax cuts, expanded credits, and changes in income taxation are major drivers of this projection.

- Medicaid and Healthcare:

The bill could also affect healthcare spending, potentially tightening Medicaid eligibility rules, which could indirectly affect financial planning for healthcare costs in retirement.

- Timeline:

After passing the House on May 22, 2025, the Senate is aiming to finalize its version before the July 4 recess, intending to bundle it with a new debt-ceiling increase. There is still disagreement on these even within the majority party, so the deadline is currently up in the air.

The Bottom Line (for Now)

Given these proposals are still in flux, flexibility will be essential in your financial strategy. Areas to watch closely include SALT deductions, family-related tax credits, changes in taxable income from tips and overtime, renewable-energy incentives, and especially the taxation of Social Security benefits.

We’re closely monitoring these developments. Rest assured that once the final details are clear, we’ll recalibrate your financial plan together – ensuring you’re positioned to make the most of these new opportunities or to mitigate any potential challenges.

Remember, my goal remains unchanged: helping you live your great life right now, confidently navigating whatever comes next. As always, I’m here if you have immediate questions or if any of these changes prompt you to rethink current plans.