Here in North Carolina, we cope with hurricanes from time to time, and like the storms, financial markets can bring bumpy weather to our investment portfolios.

However, unlike with hurricanes, which are typically in the forecast for several days at least, no one can truly see over the horizon to know when bad times – a big drop in asset values – may affect our investments. When that happens, it is more important than ever to have, and to follow, a solid financial plan.

Sometimes the best, most rigorously developed financial advice is so obvious, it’s become cliché. And yet, investors often end up abandoning this same advice when market turbulence is on the rise. Why the disconnect? Let’s take a look at five of the most familiar financial adages, and why they’re often much easier said than done.

- If you fail to plan, you plan to fail.

- No risk, no reward.

- Don’t put all your eggs in one basket.

- Buy low, sell high.

- Stay the course.

We’ll explore each in turn, how we implement them, and why helping people stick with these evidence-based basics remains among our most important and challenging roles.

-

If You Fail to Plan, You Plan to Fail.

Almost everyone would agree: It makes sense to plan how and why you want to invest before you actually do it. And yet, few investors come to us with robust plans already in place. That’s why deep, extensive and multilayered planning is one of the first things we do when welcoming a new client, including:

- A Discovery Meeting – To understand everything about you, including your goals and interests, your personal and professional relationships, your values and beliefs, how you’d prefer to work with us … and anything else that may be on your mind.

- “Traditional” Financial Planning – To organize your existing assets and liabilities, define your near-, mid-, and long-range goals, and ensure your financial means align as effectively as possible with your most meaningful aspirations.

- An Investment Policy Statement (IPS) – To bring order to your investment universe. Your IPS is both your plan and your pledge to yourself on how your investments will be structured to best align with your greater goals. It describes your preferred asset allocations (such as your percentage of stocks vs. bonds), and is further shaped by your willingness, ability, and need to tolerate market risks in pursuit of desired returns.

- Integrated Wealth Management – To chart a course for aligning your range of wealth interests with your financial logistics: insurance, estate planning, tax planning, business succession, philanthropic intent and more.

As we’ll explore further, even solid planning doesn’t guarantee success. But we believe the only way we can accurately assess how you’re doing is if we’ve first identified what you’re trying to achieve, and how we expect to accomplish it.

-

No Risk, No Reward.

In many respects, the relationship between risk and reward serves as the wellspring from which a steady stream of financial economic theory has flowed ever since. Simply put, exposing your portfolio to market risk is expected to generate higher returns over time. Reduce your exposure to market risk, and you also lower expected returns.

We typically build a measure of stock market exposure into our clients’ portfolios accordingly, with specific allocations guided by individual goals and risk tolerances. But here’s the thing: Once you have accepted the evidence describing how market risks and expected returns are related, it’s critical that you remain invested as planned.

There’s ample evidence that periodic market downturns ranging from “ripples” to “rapids” are part of the ride. As a February 2018 Vanguard report described, from 1980–2017, the MSCI World Index recorded 11 market corrections of 10% or more, and 8 bear markets with at least 20% declines lasting at least 2 months. Such risks ultimately shape the stream that is expected to carry you to your desired destination. Consider them part of your journey.

-

Don’t Put All Your Eggs in One Basket.

At the same time, “risk” is not a mythical unicorn. It’s real. If it rears up, it can trample your dreams. So, just because you might need to include riskier sources of expected returns in your portfolio, it does not mean you must give them free rein.

This is where diversification comes in. Diversification is nothing new. In 1990, Harry Markowitz was co-recipient of a Nobel prize for his work on what became known as Modern Portfolio Theory. Markowitz analyzed (emphasis ours) “how wealth can be optimally invested in assets which differ in regard to their expected return and risk, and thereby also how risks can be reduced.” In other words, according to Markowitz’s work, first published in 1952, investors should employ diversification to manage portfolio risks.

This leads to an intriguing, evidence-based understanding. By combining widely diverse sources of risk, it’s possible to build more efficient portfolios. You can:

- EITHER lower a portfolio’s overall risk exposure while maintaining similar expected returns

- OR maintain similar levels of portfolio risk exposure while improving overall expected returns

Rarely, evolving evidence helps us identify additional or shifting sources of expected return worth blending into your existing plans. When this occurs, and only after extensive due diligence, we may advise you to do so, if practical (and cost-effective) solutions exist.

The details of how these risk/return “levers” work is beyond the scope of this article. But come what may, the desire and necessity to DIVERSIFY your portfolio remains as important as ever – not only between stocks and bonds, but across multiple, global sources of expected returns.

-

Buy Low, Sell High.

Of course, every investor hopes to sell their investments for more than they paid for them. Here are two best practices to help you succeed where so many fall short: time and rebalancing.

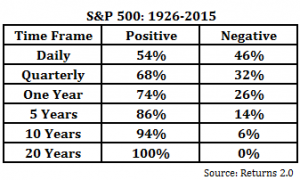

Time

By building a low-cost, broadly diversified portfolio, and letting it ride the waves of time, all evidence suggests you can expect to earn long-term returns that roughly reflect your built-in risk exposure. But “success” often takes a great deal more time than most investors allow for.

In a recent article, financial author Larry Swedroe looked at performance persistence among six different sources of expected return as well as three model portfolios built from them. He found, “In each case, the longer the horizon, the lower the odds of underperformance.” However, he also observed, “one of the greatest problems preventing investors from achieving their financial goals is that, when it comes to judging the performance of an investment strategy, they believe that three years is a long time, five years is a very long time and 10 years is an eternity.”

In the market, 10 years is not long. You must be prepared to remain true to your carefully structured portfolio for years if not decades, so we typically ensure that an appropriate portion is sheltered from market risks and is relatively accessible (liquid). The riskier portion can then be left to ebb, flow and expectedly grow over expanses of time, without the need to tap into it in the near-term. In short, time is only expected to be your friend if you give it room to run.

Portfolio Rebalancing

Another way to buy low and sell high is through disciplined portfolio rebalancing. As we create a new portfolio, we prescribe how much weight to allocate to each holding. Over time, these holdings tend to stray from their original allocations, until the portfolio is no longer invested according to plan. By periodically selling some of the holdings that have overshot their ideal allocation, and buying more of the ones that have become underrepresented, we can accomplish two goals: Returning the portfolio closer to its intended allocations, AND naturally buying low (recent underperformers) and selling high (recent outperformers).

-

Stay the Course.

So, yes, planning and maintaining an evidence-based investment portfolio is important. But even the best-laid plans will fail you, if you fail to follow them. Here, we get to the heart of why even “obvious” advice is often easier said than done. Our rational self may know better – but our instincts, emotions and behavioral biases get in the way.

Three particularly important biases to be aware of in volatile markets include tracking-error regret, recency bias, and outcome bias.

Tracking-Error Regret

When we build your portfolio, we typically structure it to reflect your goals and risk tolerances, by diversifying across different sources of expected risks and returns. Each part is expected to contribute to the portfolio’s unique whole by performing differently from its counterparts during different market conditions. Each portfolio may perform very differently from popular “norms” or benchmarks like the S&P 500 … for better or worse.

When “worse” occurs, and especially if it lingers, you are likely to feel tracking-error regret – a gnawing doubt that comes from comparing your own portfolio’s returns to popular benchmarks, and wishing yours were more like theirs.

Remember this: By design, your factor-based, globally diversified portfolio is highly likely to march out of tune with typical headline returns. It can be deeply damaging to your plans if you compare your own performance to benchmarks such as the general market, the latest popular trends, or your neighbor’s seemingly greener financial grass.

Recency

Recency causes us to pay more attention to our latest experiences, and to downplay the significance of long-term conditions. When an expected source of return fails to deliver, especially if the disappointment lasts for a while, you may start to second-guess the long-term evidence. This can trigger what Nobel laureate and behavioral economist Daniel Kahneman describes as “what you see is all there is” mistakes.

Again, buying high and selling low is exactly the opposite of your goals. And yet, recency causes droves of investors to chase hot, high-priced holdings and sell low during declines. Irrational choices based on recency may still turn out okay if you happen to get lucky. But they detour you from the most rational, evidence-based course toward your goals.

Outcome Bias

Sometimes, even the most rational plans don’t turn out as hoped for. If you let outcome bias creep in, you end up blaming the plan itself, even if it was simply bad luck. This, in turn, causes you to abandon your plan. Unfortunately, it’s rarely replaced with a better plan, which brings us back to our first adage about those who fail to plan.

To illustrate, let’s say, several years ago, we created a solid investment plan and IPS for you. At the time, you felt confident about them. Since then, we’ve periodically refreshed your plan, based on your evolving personal goals, perhaps a few new academic insights, and any new resources now available for further optimizing your portfolio.

Now, let’s say the markets disappoint us over the next few years. Ugly red numbers take over your reports, seemingly forever. Before you conclude your underlying strategy is wrong, remember: It’s far more likely you’re experiencing outcome bias (with a recency-bias chaser).

Investing will always contain an element of random luck. From that perspective, in largely efficient markets, your best course remains – you guessed it – to stay the course with your existing, carefully crafted plans. While even evidence-based investing doesn’t guarantee success, it continues to offer your best odds moving forward. Don’t lose faith in it.

Simple, But Not Easy

Let’s wrap with a telling anecdote. Merton Miller was another co-recipient of the aforementioned 1990 Nobel prize. Miller’s portion was in recognition of his “fundamental contributions to the theory of corporate finance.” While his findings were deep and far-reaching, he once summarized them as follows:

[I]f you take money out of your left pocket and put it in your right pocket, you’re no richer. Reporters would say, ‘you mean they gave you guys a Nobel Prize for something as obvious as that?’ … And I’d add, ‘Yes, but remember, we proved it rigorously.’”

Like Miller’s light take on his heavy-duty findings, some of what we feel is our best advice seems so simple. And yet, in our experience, it’s very hard to adhere to this same, “obvious” advice in the face of market turbulence.

Blame your behavioral biases. They make simple advice deceptively difficult to follow. We all have them, including blind spot bias. That is, we can easily tell when someone else is succumbing to a behavioral bias, but we routinely fail to recognize when it’s happening to us.

This is one reason it’s essential to have an objective, professional advisor (along with your network of informal advisors) who is willing and able to let you know when you’re falling victim to a bias you cannot see in the mirror. At PLC Wealth, that is exactly what we are here for! Let us know if we can help you reflect on these or any other challenges that stand between you and your greatest financial goals.