Do you ever stop to smell the roses, literally? As we transition from the vibrant days of spring into the warmth of summer, it’s a wonderful time to pause and reflect on the beauty that surrounds us. Whether it’s the blooming gardens, the long sunny days, or the simple pleasure of an evening walk, I encourage you to take a moment to appreciate the small joys of the season. These have a way of putting the world’s crazy into perspective, which is necessary if we are going to stay happy, healthy individuals for all our days.

Market Overview

So let’s talk a little ‘crazy’…As we enter the third quarter of 2024, we find ourselves in a financial environment marked by both challenges and opportunities. Year to date, it seems that diversification is missing out on huge gains coming from just a few stocks. Not only have many broad markets delivered gains from acceptable to amazing, but there has also been the usual assortment of sizzling stocks like NVIDIA (NVDA), and tantalizing new products like crypto ETFs to distract us with their dazzle.

Strong market performance is welcome news. But at least in the wider investment world, we’re likely to see a different kind of response that isn’t as welcoming: Instead of fleeing the downturns, restless market players may be tempted to chase after speculative trends, no matter how closely they resemble past Fear of Missing Out (FOMO) frenzies. There’s almost always something alluring and allegedly unprecedented to fuel our FOMO. But before you go all-in on the most recent high-flyers, remember:

The latest innovations are often very real, remarkable, and potentially game-changing forces in our lives. But the manner in which capital markets absorb these forces and convert them into long-term returns is far more constant.

Which reinforces why our own refrain remains the same whether markets are up or down:

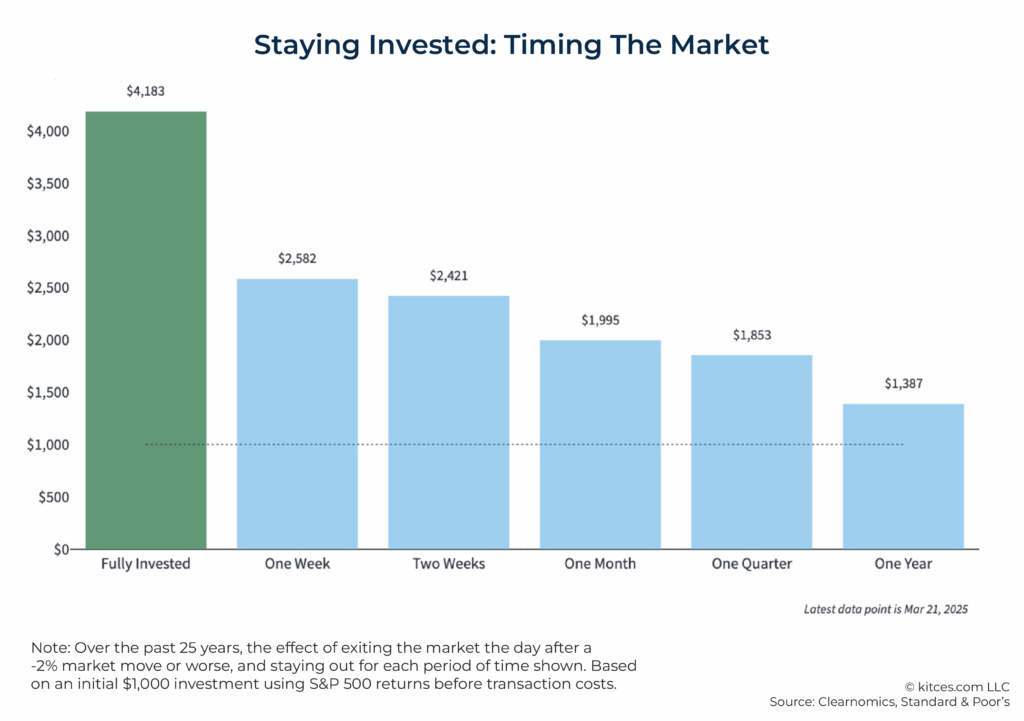

Neither hot nor cold streaks among stocks, sectors, or markets give us good reason to abandon an otherwise well-built portfolio.

Staying the Course

It’s natural to feel anxious during periods of uncertainty, but it’s crucial to remember that our financial plan is designed to withstand these fluctuations. History has shown that markets tend to recover and grow over time, despite periodic downturns. Our diversified approach to investing is intended to mitigate risk and provide a stable foundation for your financial future.

This is why we still advise building and maintaining a low-cost, globally diversified investment portfolio aimed at your personal long-term goals. This, despite the cognitive traps laid by the most recent rounds of FOMO. As Nobel laureate Daniel Kahneman reportedly observed quite bluntly:

“If you think you’re an expert on picking stocks, then you should be fabulously rich. If you’re not, you’re probably not.” — Daniel Kahneman

Controlling What You Can

Now on to the ‘happy and healthy’ part…While we cannot control the markets or political developments, we can control how we respond to them. It’s essential to focus on the aspects of life that are within our power to manage. One such area is aligning our lives with our values and priorities. Living according to what truly matters to you can provide a sense of purpose and fulfillment that transcends financial concerns.

One way to foster this alignment is by integrating movement and adventure into your daily routine. Research has consistently shown the profound benefits of physical activity on both physical and mental health. It has become very clear that regular physical activity and engaging in adventurous activities can significantly enhance one’s healthspan—the period of life spent in good health, free from chronic diseases and disabilities.

The Value of Movement and Adventure

Engaging in physical activities, whether it’s trail running, hiking, or simply taking a walk in the park, can have a transformative impact on your overall well-being. Movement not only improves cardiovascular health, strengthens muscles, and boosts energy levels but also reduces stress and enhances mental clarity. Adventure, on the other hand, introduces an element of excitement and novelty that can invigorate the spirit and foster a sense of achievement.

Incorporating movement and adventure into your life doesn’t have to be a grand endeavor. It can be as simple as exploring a new hiking trail, trying a new sport, or setting aside time each day for a brisk walk. The key is to make it a regular part of your routine, allowing it to become a habit that supports your health and happiness.

Embracing Life’s Adventure

Beyond the physical benefits, adventure can also serve as a metaphor for how we approach life’s challenges and opportunities. Embracing adventure means being open to new experiences, taking calculated risks, and stepping out of our comfort zones. It’s about seeing life as a journey filled with possibilities, rather than a series of obstacles to overcome.

As you navigate the complexities of the financial markets and the uncertainties of the world, we encourage you to adopt an adventurous mindset. Approach each day with curiosity and a willingness to explore. Trust in the financial plan we have crafted together, knowing that it is designed to support your long-term goals. And most importantly, prioritize your well-being by staying active and embracing the adventures that life has to offer.

In closing, we want to express our gratitude for your continued trust and partnership. Let’s make this quarter a time of growth, both financially and personally. Embrace the beauty of the season, stay active, and approach each day with a sense of adventure. By focusing on the aspects of life we can control and maintaining a sense of adventure, we can navigate the uncertainties of the financial world with confidence and resilience. Thank you for allowing us to be part of your journey.